Living Trusts vs. Wills: What’s the Best Estate Planning Strategy for Canadians?

Most Canadians think a will is enough to protect their assets. Spoiler: It’s not.

A will dictates who gets what when you die, but it doesn’t help minimize taxes, avoid probate, or keep your estate private. That’s where a living trust comes in. If you’re sitting on a real estate portfolio, investments, or a business, you might be losing tens of thousands to taxes and legal fees by not structuring things properly.

So, which one is right for you? Let’s break it down.

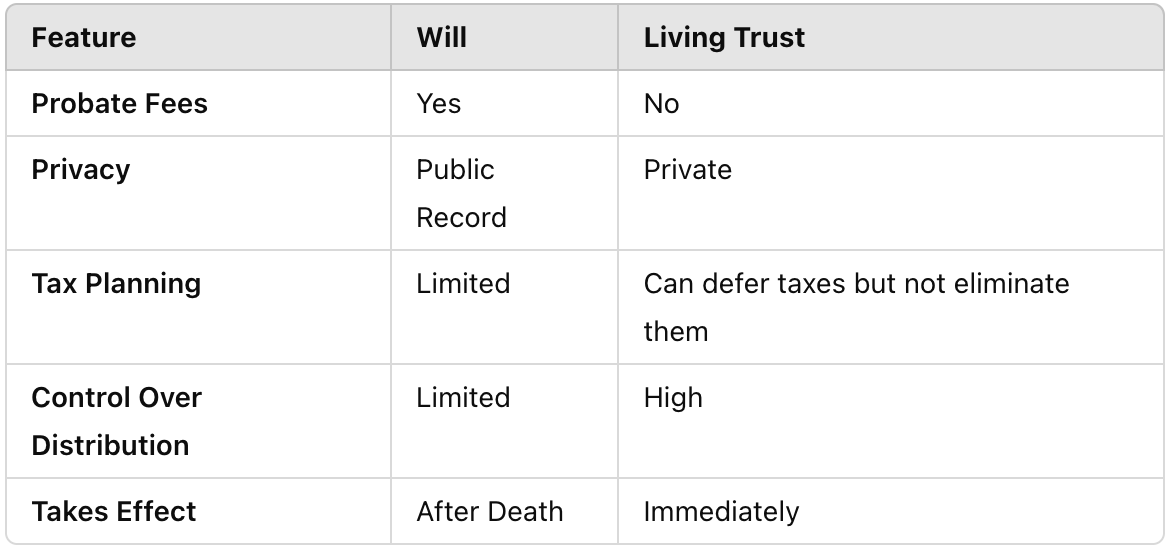

1. Wills vs. Living Trusts: The Key Differences

TL;DR: A will just says who gets what. A trust lets you control when and how they get it—while cutting probate costs.

2. The Problem with Just Having a Will

🚨 Probate Fees: The government takes a cut before your heirs see a dime.

🚨 Public Process: Anyone can look up your will after you die (yes, even nosy neighbors).

🚨 Delayed Asset Transfers: Probate can take months to over a year, depending on the complexity of your estate.

🚨 No Tax Deferral: If you own investment properties or a business, expect a big tax bill when you pass away.

3. When a Living Trust Makes More Sense

A living trust isn’t just for the ultra-wealthy. It’s for anyone who wants to:

✅ Avoid probate: Assets transfer smoothly and privately.

✅ Reduce taxes: Trusts can defer capital gains but won’t eliminate tax liability.

✅ Protect assets: Some irrevocable trusts offer creditor protection (but not revocable ones).

✅ Control wealth transfer: Give money over time instead of a lump sum (so your 19-year-old doesn’t blow their inheritance on a Lambo 🚗💨).

4. The Two Main Types of Living Trusts

🔹 Revocable Trusts: You stay in control, but assets remain in your estate (meaning no creditor protection and no tax sheltering).

🔹 Irrevocable Trusts: You lose control, but you get stronger asset protection and potential tax benefits.

💡 Bonus for Canadians 65+ → Alter Ego Trusts let you transfer assets tax-free and defer capital gains tax until death, avoiding the CRA’s 21-year deemed disposition rule.

5. Who Should Use a Living Trust?

You should seriously consider a trust if you:

✅ Own real estate (beyond your primary home).

✅ Have an investment portfolio that’ll trigger capital gains taxes.

✅ Run a business and want a smooth succession plan.

✅ Want to avoid probate and legal drama for your heirs.

✅ Are 65+ and want to transfer assets tax-free.

6. What’s the Catch?

❌ Setting up a trust costs more upfront than a will.

❌ Requires ongoing management and legal oversight.

❌ Not ideal for small estates with minimal assets.

👨⚖️ Pro Tip: A will is still important! Most people need both a will and a trust to cover all their bases.

Final Takeaway: What’s Right for You?

✔️ If you just own a home and some savings → A will is probably fine.

✔️ If you have multiple properties, a business, or investments → A living trust is likely the smarter move.

✔️ If you’re 65+ and looking to protect wealth → An alter ego trust could save you a fortune in taxes.

📢 Talk to a tax advisor or estate planner to build the best plan for your situation.

This information is provided for educational purposes, and readers are encouraged to conduct their own research before making investment and financial decisions.