Metro Vancouver rents remain depressingly high despite B.C. price drop

HOME BUYERS – To get the best exclusive listings visit www.vreg.ca and go to “EXCLUSIVE DEALS”

Read More

British Columbia is tied for the largest annual decline in apartment rents in all of Canada, but Metro Vancouver renters may not be seeing the savings when it’s time to pay.

According to the latest Rentals.ca and Urbanation report, which looks at numbers from June 2025, the country’s average asking rent for all residential properties declined 2.7 per cent year-over-year. It was the ninth consecutive month of annual rent drops.

B.C. and Alberta experienced the biggest annual decline in apartment rents at 3.1 per cent. However, four of the top five most expensive cities to rent in the top Canadian markets list remain in the Metro Vancouver area.

Alen Szylowiec/Shutterstock

“Asking rents for purpose-built and condo rental apartments declined the most over the past year in B.C. and Alberta, each decreasing by 3.1 per cent, to an average of $2,472 and $1,741, respectively,” said Rentals.ca in its report.

“Ontario and B.C. were the only provinces to record a two-year decrease in apartment rents, declining 3.6 per cent and 3.1 per cent, respectively.”

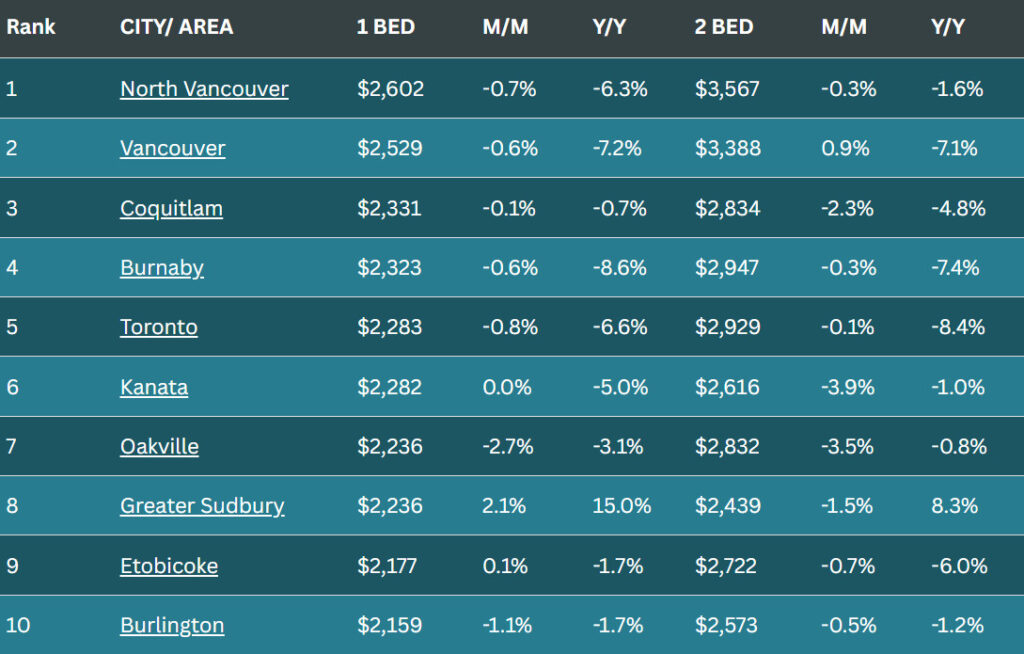

According to Rentals.ca, North Vancouver is the most expensive municipality in Canada to rent for the fourth consecutive month, with the average asking rent for a one-bedroom rental reaching $2,602 per month and a two-bedroom rental coming in at $3,567 per month.

Vancouver, Coquitlam, Burnaby, and Toronto round out the other five most expensive places to rent in the country.

Rentals.ca

The report also shows that among Canada’s six largest cities, Vancouver experienced the second-largest annual decline in apartment rents in June, dropping seven per cent. However, the asking rent for a one-bedroom is $2,529 per month, and for a two-bedroom, it is $3,388 per month.

“Despite the dip in rents during the past year, average asking rents in Canada remained 4.1 per cent higher than the level from two years earlier ($2,042) and 11.9 per cent higher than the level from three years earlier ($1,899),” added Rentals.ca

Volodymyr Kyrylyuk/Shutterstock

Several other B.C. cities also cracked the 50 priciest Canadian markets to rent, including New Westminster at number 17, Victoria at number 19, Langley at number 21, Surrey at number 26, and Nanaimo at number 31.

Average asking rents in Canada remain 5.7 per cent higher than two years ago and 12.6 per cent higher than three years ago.

Are you a renter who’s seeing a drop in the asking rent price? Are you experiencing challenges finding a rental within your budget? Let us know in the comments or get in touch at [email protected].