Nearly 4,300 properties in Broadway Plan and Cambie Plan areas to be proactively rezoned by the City of Vancouver

HOME BUYERS – To get the best exclusive listings visit www.vreg.ca and go to “EXCLUSIVE DEALS”

Read More

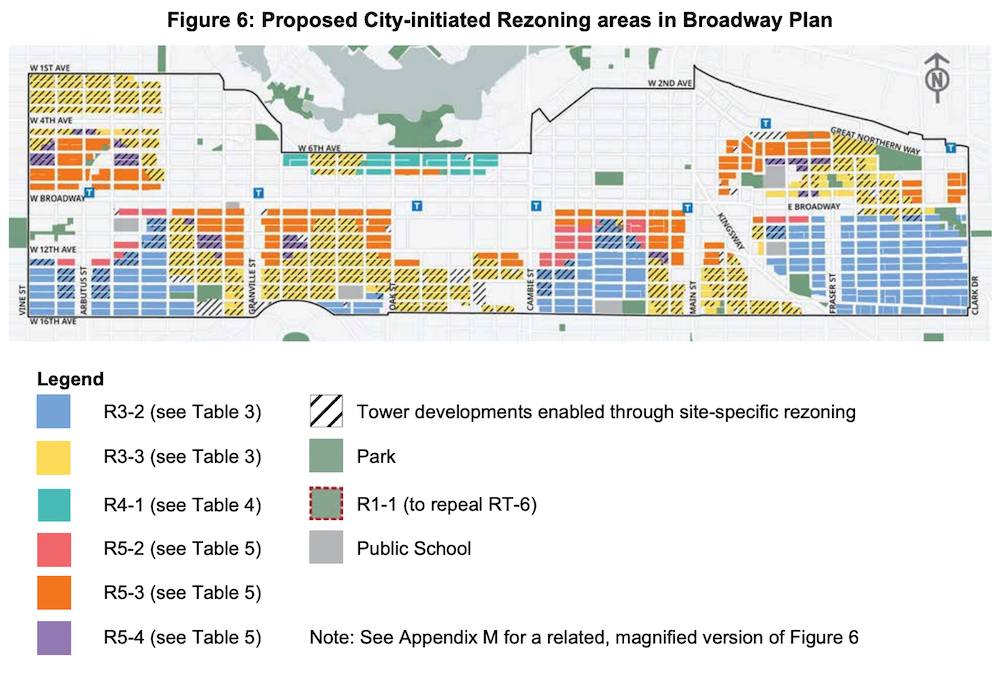

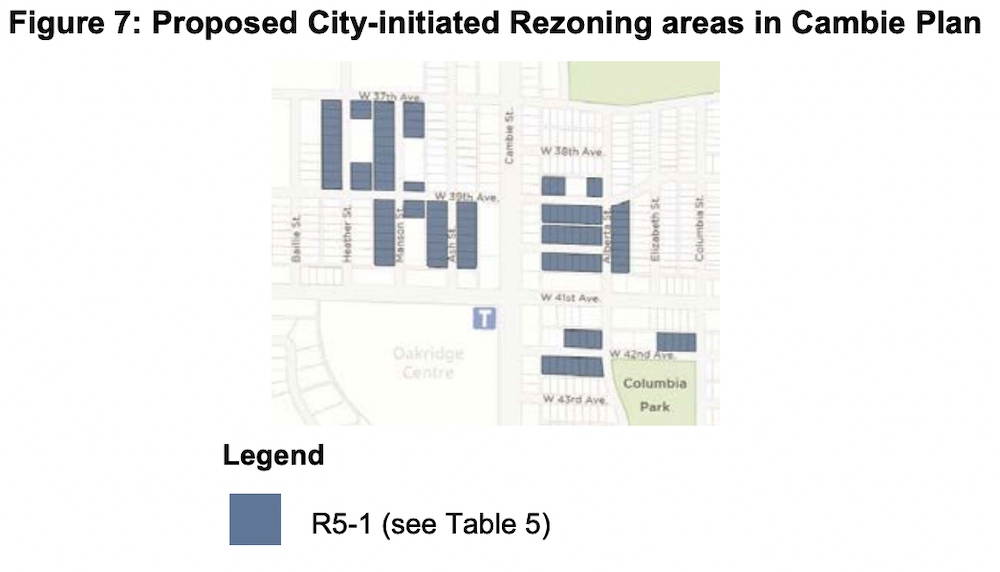

The City of Vancouver is moving forward with a sweeping proposal to proactively rezone thousands of properties in the Broadway Plan and Cambie Corridor Plan areas, as part of an ambitious effort to streamline the development process and boost housing supply near existing and future SkyTrain stations.

In next Tuesday’s public meeting, City Council is expected to endorse City staff’s recommendation to refer bylaw amendments to a future public hearing for deliberation and final decision, which would likely be held in September or October — after the forthcoming summer break.

This follows City staff’s public consultation beginning in March 2025, when they first announced the proposal. In an interview with Daily Hive Urbanized early this year, Josh White, the City of Vancouver’s general manager of planning, urban design, and sustainability and director of planning, also outlined many of these forthcoming changes.

More details have now been released.

If approved by City Council later this year, this would introduce standardized zoning for low-rise, mid-rise, and high-rise residential buildings — generally aligning with the existing prescriptions and stipulations of the property’s location under the Broadway Plan or Cambie Corridor Plan, while also considering more recent economic and financial viability factors.

Generally, R3 zones would allow low-rise apartments up to six storeys — or eight storeys with affordable housing, and a floor area ratio (FAR) density of a floor area up to three times the size of the lot. R4 zones would support mid-rise buildings, typically around 12 storeys and a FAR density of up to 4.0. R5 zones would permit high-rise towers up to 22 storeys and a FAR density of up to 6.5, depending on the proximity to SkyTrain stations and affordability requirements.

It is noted that FAR densities will be retained, but a more generous maximum building height will be considered to accommodate a greater range of design approaches due to varying site conditions and on-site public spaces and landscaping.

Through such City-initiated rezoning over large swaths of neighbourhoods, this eliminates the need for property owners, developers, and builders to submit an individual rezoning application for their project. Instead, such projects on a City-initiated rezoned site can go straight to the development permit application, which will save applicants costs related to City fees and hiring architects and consultants to achieve the rezoning regulatory step, as well as reducing opportunity costs and added construction costs from inflation as a result of a longer timeline.

City staff estimate that these blanket zoning reforms over the qualifying properties will shave 12 to 15 months off the overall development timeline.

As well, this will reduce City staff’s time set aside for reports and public hearings with City Council, enabling them to reallocate resources to other tasks and priorities. So far in 2025, rezoning applications in the Broadway Plan and Cambie Corridor Plan account for about 40 per cent of all public hearings.

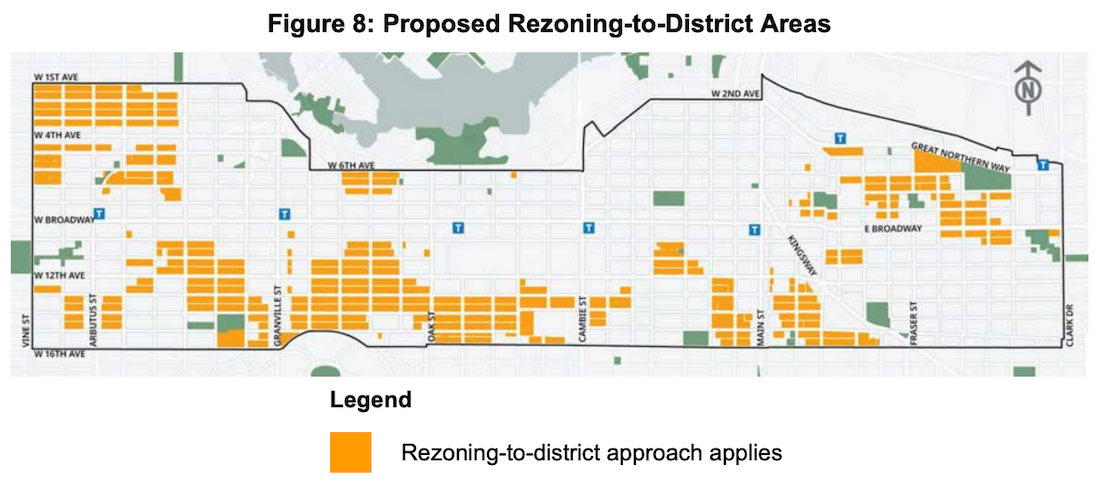

In sites where a tower form is permitted and complex site conditions also exist — such as tower per block limit policies, building shadowing considerations, and contaminated soils, a “rezoning-to-district” process would still be required. This rezoning-to-district process would be streamlined and shorter than the standard rezoning process.

The overwhelming majority of these properties are located within the Broadway Plan area, specifically sites closest to the Millennium Line’s future stations on the Broadway extension, as well as southern areas within the area plan. For the Cambie Corridor Plan area, the properties are clustered near the Canada Line’s Oakridge-41st Avenue Station.

In total, the City-initiated rezoning would apply to 4,294 parcels across the Broadway Plan and Cambie Corridor Plan areas.

City of Vancouver

City of Vancouver

City of Vancouver

Over the last few years, the municipal government performed some notable City-initiated rezonings of large single-family neighbourhood areas in the Cambie Corridor Plan, enabling more expedited townhouse developments as already prescribed by the area plan.

However, the forthcoming changes are the largest standardized rezoning in Vancouver’s history, and align with the Government of British Columbia’s legislated requirements for the City and other municipal governments. This specifically aligns with provincial legislation relating to transit-oriented development at designated Transit-Oriented Areas and other regulatory changes.

As well, through these changes, the City will standardize affordable housing requirements using newly enabled provincial inclusionary zoning powers.

Additionally, the real estate industry and provincial officials have called individual site-specific rezoning applications as redundant if the proposed uses and built form are already enabled by an area plan.

In addition to aligning with the Broadway Plan and Cambie Corridor Plan, the changes also follow the City’s 2022-approved Vancouver Plan.

While there was strong support for the initiative during the public consultation earlier this year — especially for its potential to speed up much-needed housing — concerns were raised about neighbourhood character, infrastructure capacity, and construction impacts. City staff responded by noting that all developments will still undergo design review, and there will still be an opportunity for public input at the development permit application stage.

Enhanced tenant protections will remain in place for areas with existing rental housing. A time-limited approach will allow current rezoning applicants to transition into the new zoning framework without redoing tenant relocation plans, as long as they submit development permits within one year of bylaw enactment.

Currently, there are about 40 in-stream rezoning applications involving Tenant Relocation Plans within the proposed City-initiated rezoning areas. It is noted that some of these project applicants may withdraw their current rezoning application to take advantage of the new City-initiated rezoning, enabling them to go straight to the development permit application.

The zoning overhaul builds on earlier implementation phases of the Broadway Plan and Cambie Corridor Plan, and precedes an upcoming city-wide Design and Development Guidelines update planned for 2026.

Earlier this month, City Council also approved the transit-oriented development strategy of the Rupert and Renfrew Station Area Plan — the first area plan since the 2022 approval of the Broadway Plan. Later in 2025, City staff will return to City Council to seek approval for similar City-initiated rezonings covering a substantial portion of this newest area plan, specifically to enable new low-rise apartment uses.