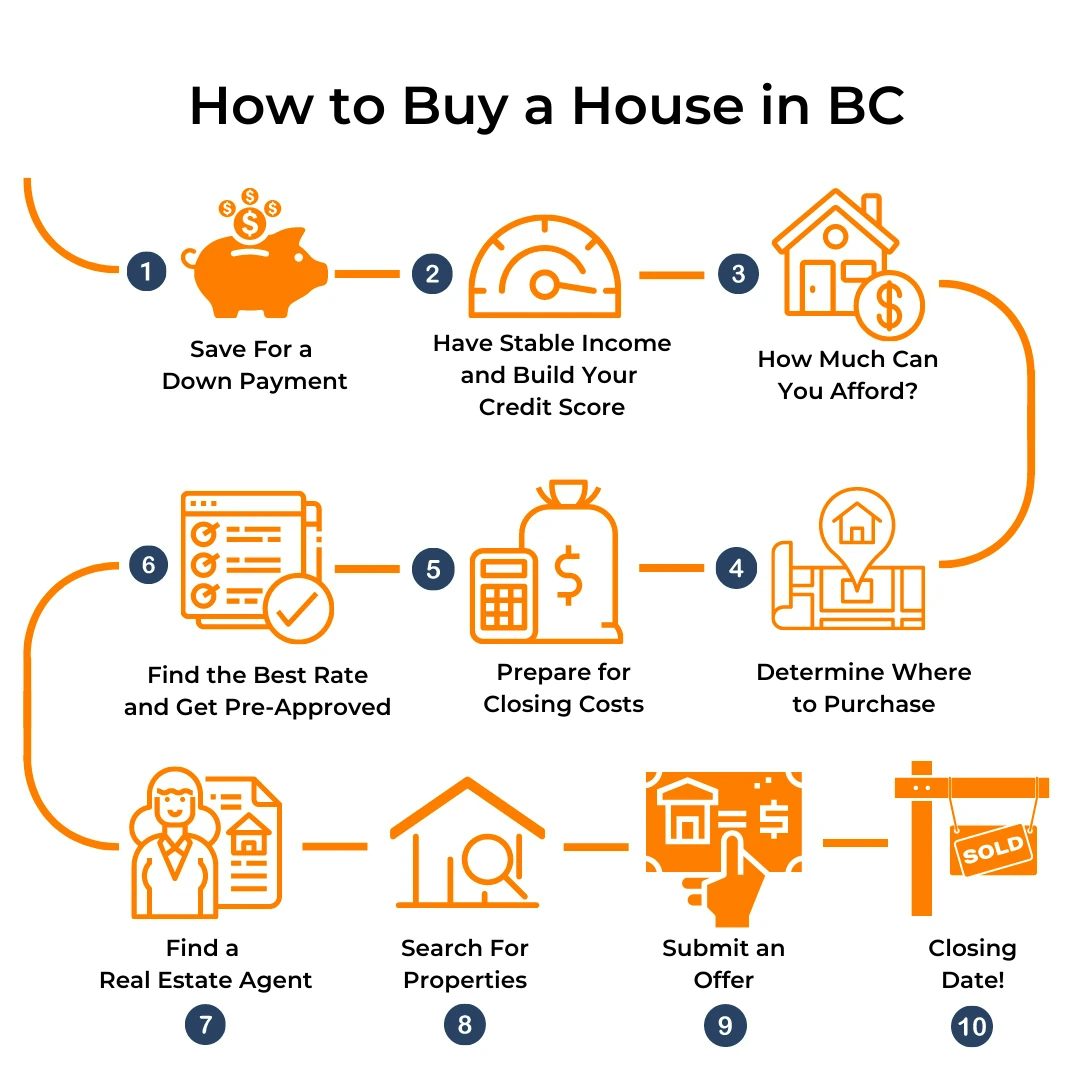

How to Buy a House in British Columbia Canada

Buying a house is no small feat. It is one of the biggest and most important purchases that you can make in your lifetime, meaning it is important to get it right. What really makes the process a success is if you are able to move into a home you can see yourself living-in, while staying on budget. Since this process is a multi-stepped one, we have put together a 10 step guide to buying a home in beautiful British Columbia.

Before embarking on this process, it is important to determine if now is the right time for you to make this purchase, both financially and mentally. Especially in areas around Vancouver, where housing prices have soared over the last decade, affordability is top of mind in this decision. Helpful resources to consider to help you make this tough decision of whether now is the right time or not include:

- Talking with a real estate agent and mortgage broker,

- Trying WOWA’s rent vs buy calculator , and

- Talking the decision over with family and close friends

No matter what you decide is best for you, having an understanding of the process will help you no matter when the time comes.

Step 1. Saving For a Down Payment

Having a sizable down payment is crucial, especially when competing in housing markets such as Vancouver, where the average sale price is $1,150,000. After hearing this, you may be wondering: how much down payment for a house in BC do I need? With houses over $1,000,000, you will need a minimum 20% down, meaning if you’re in the Vancouver area and buying a house for the average home price, you will need at least $230,000 for a down payment. If you are buying a house for under $500,000 on the contrary, you will only need a minimum of 5% down. If you plan on buying a house between $500,000 & $999,999, your down payment will be at least 5% for the first $500,000, and 10% on every dollar above $500,000, all the way up to $999,999. It’s also important that should your down payment be below 20% for a home sale under $1,000,000, you will need mortgage insurance. Premiums can be as much as:

- 4% of your mortgage amount for down payments between 5% & 9.99%,

- 3.10% of your mortgage amount for down payments between 10% & 14.99%, and

- 2.8% of your mortgage amount for down payments between 15% & 19.99%

No matter where you are buying and for how much, you will need to have a large amount of savings in order to make your home buying goals a reality. If you’re curious how much down you will need to save for your home purchase, check out WOWA’s down payment calculator. To calculate your GDS ratio, you will need to know how much your mortgage paymentswill be. You can find out this amount by using a WOWA’s down payment calculator.

When thinking about saving for a house, having a strict budget can be one way to make your down payment goals a reality. If you want a large down payment or need one because the market you’re looking in is very expensive, it may require cutting down on some discretionary expenses to help enhance your savings. As well, another option to kickstart the down payment savings process is to do some side work, including finding a side job or freelancing. If your income is already sufficient to meet your expenses and still put some money aside, a side job or freelancing can go straight to your down payment savings, speeding up the process.

Finally, many government programs offered to first time home buyers can help you meet your home buying goals, including:

- The First Time Home Buyers Incentive, where you can receive up to $25,000 in shared home equity from the Canadian Government for homes up to $722,000,

- British Columbia Property Transfer Tax rebates, where properties under $525,000 will receive tax exemptions, and houses under $500,000 will be Property Transfer Tax-free, and

- The Home Buyers Plan, where you can use your RRSP savings for up to $60,000 in the form of a tax-free down payment

Spending the time to understand how and if these programs can help you will make a big difference in affording your first home.

If you don’t have enough down payment for purchasing a home, you can also consider an option such as rent-to-own programs.

Step 2. Have Stable Income & Build your Credit Score

Especially when buying into an expensive market like in many cities in British Columbia, having a stable source of income is crucial. This stability will allow you to make your housing payments and save, which can really add up in such an expensive province to buy.

As well, homeownership at times can be uncertain. If something is to break or go wrong in your house, having the income or savings to cover these unexpected expenses can relieve multitudes of stress. Especially if you’re self-employed or a contract worker with a less stable income, it’s crucial to put money aside into a savings account every paycheck to prepare for any surprises. In addition, besides just your mortgage and interest payments, expenses such as home insurance, property tax, and utilities all add up and add to your monthly housing costs. You can use our guide to get home insurance from Canada’s top 15 companies.

Your Credit score is a key indicator in how creditworthy you are, and is one of the primary ways lenders assess you. Besides just lenders, the CMHC, who provides mortgage insurance on houses below $1,000,000, requires a credit score above600. This means that if you’re planning on purchasing a home below $1,000,000 and with less than 20% down, you will want to check if your credit score meets this criteria, and work on improving your credit score if it doesn’t.

If your credit score isn’t that high, it doesn’t mean you won’t be able to find a lender. There are many private mortgage lenders and B-lenders who are options to turn to, however mortgage rates from these lenders tend to be much higher than the banks or an insured mortgage. This means that it may make more financial sense to work on building up your credit score and building a bigger down payment.

Step 3. How Much Can You Afford?

Understanding your financial scenario is the next crucial step on the path to home ownership. Aside from minimum requirements for obtaining loans, including: necessary credit scores, down payment amounts, debt service ratio limits, and monthly expenses, feeling comfortable with the amount you spend should always come first. When you do discover how much you want to spend on a home, setting a strict budget will help prevent yourself from creating added stress and potential financial hardship.

To get a better understanding of how much you may be able to afford, WOWA’s affordability calculator makes it easy.

Step 4. Determining Where to Purchase

When determining where to focus your search and where you can see yourself living, checking out neighborhoods and doing some research can help you make a more informed choice. This can include:

- Doing neighbourhood drive-bys to see what it’s like,

- Researching schools in the catchment area,

- Determining how long your commute time will be and if public transportation is feasible, and

- Doing research into the neighbourhood and determining how safe it is

It is important to remember that cosmetics in a house can always be changed, however the location cannot. Especially if it’s your first home or you’re on a tight budget, getting a location that you can see yourself living in is one of the most important characteristics. Considering you can always do upgrades as you start to pay off your mortgage, with the help of a home equity line of credit or when you refinance, finding the right location should be something you think long and hard about.

Step 5. Prepare for Your Closing Costs

Besides the purchase price of a home, the closing costs associated with it make up the next largest expense. This makes understanding these costs extra important so that you can still remain comfortable in your financial situation. The largest component of closing costs are Property Transfer Taxes, which is taxed at the following marginal rates in British Columbia:

| Purchase Price of a Home | Property Transfer Marginal Tax Fee |

|---|---|

| First $200,000 | 1.0% |

| $200,000 – $2,000,000 | 2.0% |

| $2,000,000 – $3,000,000 | 3.0% |

| Over $3,000,000 | 5.0% |

However, as discussed in step 1, as long as your home price is less than $500,000, you will be eligible for a rebate that covers all your Property Transfer Tax. Prices up to $525,000 will also get a rebate, however it will not cover the whole amount.

Other closing costs involved in buying a house in BC can include:

- Lawyer & Legal Fees,

- Property Survey cost,

- Home Inspection cost,

- Property Appraisal fees,

- Title Insurance,

- Government Registration fees, and

- An Estoppel Certificate fee

Having room within your budget for these costs ahead of searching for a home will allow you to be aware of the true cost of buying a home.

Step 6. Get Pre-approval & Search out the Best Rate

The reason why getting a pre-approval on a mortgage is so important is because it gives you more information on your budget. This information can include:

- How much you can afford to spend,

- How much your lender is willing to give you to spend,

- Your Prospective interest rate, and

- A snapshot of what your monthly payments could add up to

All of this information should be thought of when making a purchase and informing your budget, meaning a pre-approval is very important.

Even when you do get pre-approved, it doesn’t mean that you are unable to shop around for different mortgage rates. It is highly recommended that you check around before committing to a rate or a mortgage lender, as you could be saving thousands of dollars in interest.

For example, you got pre-approved to finance up to $1,500,000 for a house in Vancouver. Regardless of how much the home you find costs, your down payment will be 20%. The bank you got pre-approved from is the same one you have your bank account with, and the terms are:

- 5 year fixed loan, with

- 2.44% interest rate

The time comes and your offer to purchase a $1,100,000 house is accepted. Instead of going through with the pre-approved mortgage you have lined up, you decide to search around. With the mortgage you have lined up, you will pay $98,863 in interest charges over the 5 year term.

You then come across another lender who is offering a loan at a 1.99% interest rate also on a 5 year fixed term. With this loan, you will be paying $80,350 in interest over the term. After comparing the difference, you realize that by shopping around for a better rate, you will save $18,513 in interest over the 5 year term!

Step 7. Find Your Real Estate Agent

As a buyer, you will not be paying the real estate commission directly, meaning it’s a very worthwhile proposition to have a real estate agent to support you on this journey. Real estate agents are experienced professionals and can be there for you for anything along the process, including:

- Moral support,

- Offer strategies,

- Finding properties to show you,

- Neighbourhood advice, and

- Drafting and sending paperwork

Step 8. Search for Properties Within Your Price Range

Now that you have an agent to help show you properties and to start up the home search, it’s important to put together a list of nice-to-haves and need-to-haves. Under need-to-haves, this list should include details such as:

- # of bedrooms,

- # of bathrooms,

- General location, and

- Type of property

When making a list of nice-to-haves, this should include details such as:

- Type of finishings,

- Extra rooms,

- Landscaping, and

- Technological enhancements

The main difference is need-to-haves are things that you cannot change about the property, while nice-to-haves are more cosmetic and can be changed. If you come across a property that is priced significantly lower than other comparable properties in the area, it may be a leasehold property.

When you’re on the hunt, looking both with your agent and online through your local MLS, it’s always important to keep an open mind and move quickly; especially if you’re looking in a hot real estate market!

Step 9. Submit an Offer

If the property fits both your need-to-haves and the budget you’re comfortable going to, then the next step is to submit an offer! Although you may fall in love with a house, it’s important to know that the first house you put an offer on might not be accepted. That’s ok! It’s important to remain positive throughout, and use your family, friends, and real estate agent as people to help with this.

Eventually, with a positive attitude, some resilience, and a bit of luck, your offer will be accepted for the right house.

Step 10. Closing Date!

The day has finally arrived! This can be both a very exciting and stressful time. Besides packing your belongings, hiring a moving company, and enlisting the help of your friends and family, you will have to pay your closing costs! Don’t worry however, you budgeted for them well in advance when you were on step 5! When calculating them, WOWA’s closing cost calculator makes it simple. By thinking ahead, you are able to refocus your stress on painting the walls and making sure furniture fits!

The Bottom Line

After reading this guide, you’re much more prepared for down payment savings, determining where to purchase, finding a real estate agent, and finding a home to put an offer on. When undertaking this process, it’s essential to remain positive and lean on your support group. Whether it be your agent, mortgage broker or family and friends, they are all here to help you with this big decision. If you are buying an investment property, then you should also understand the eviction process in BC.